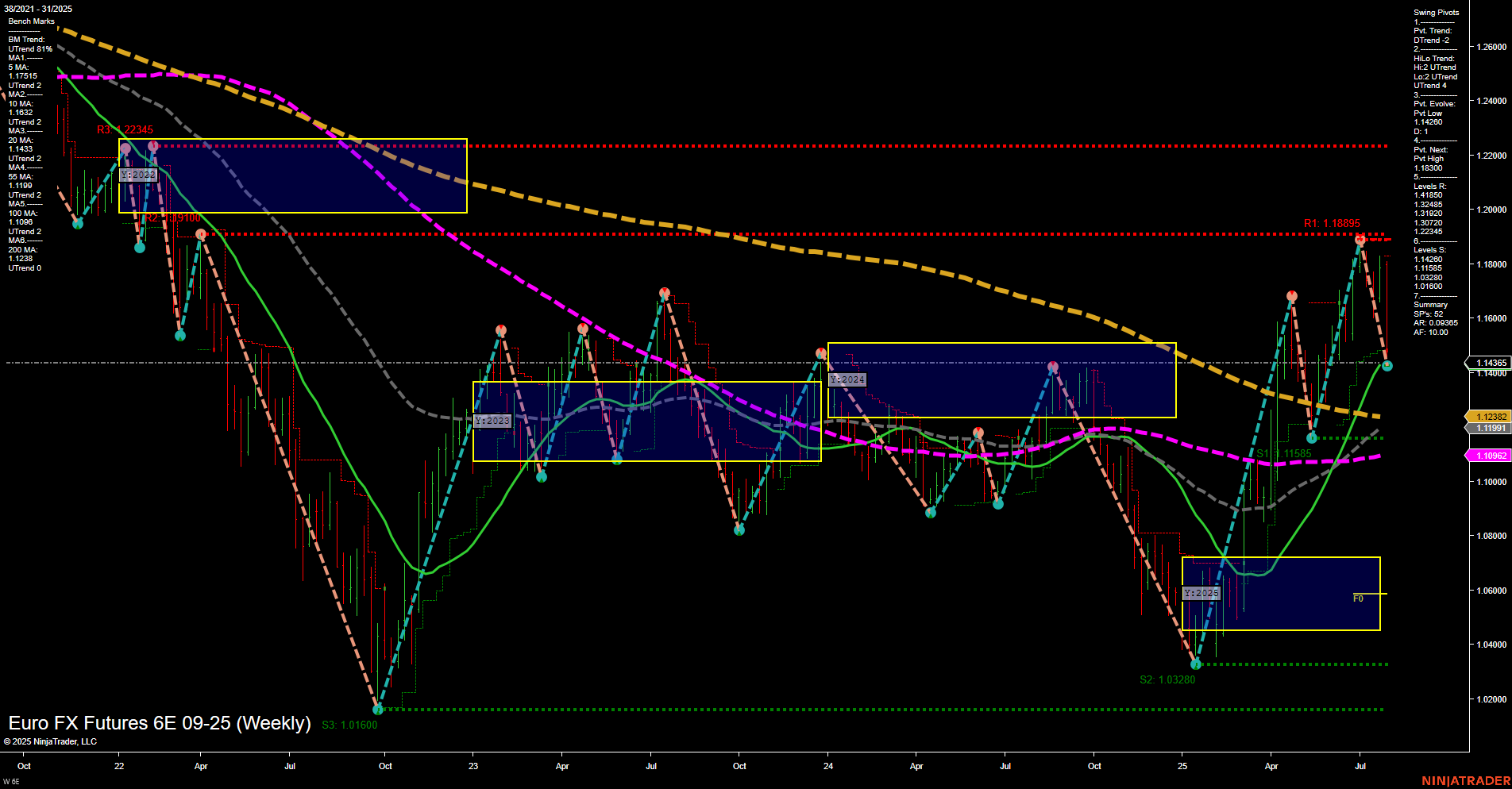

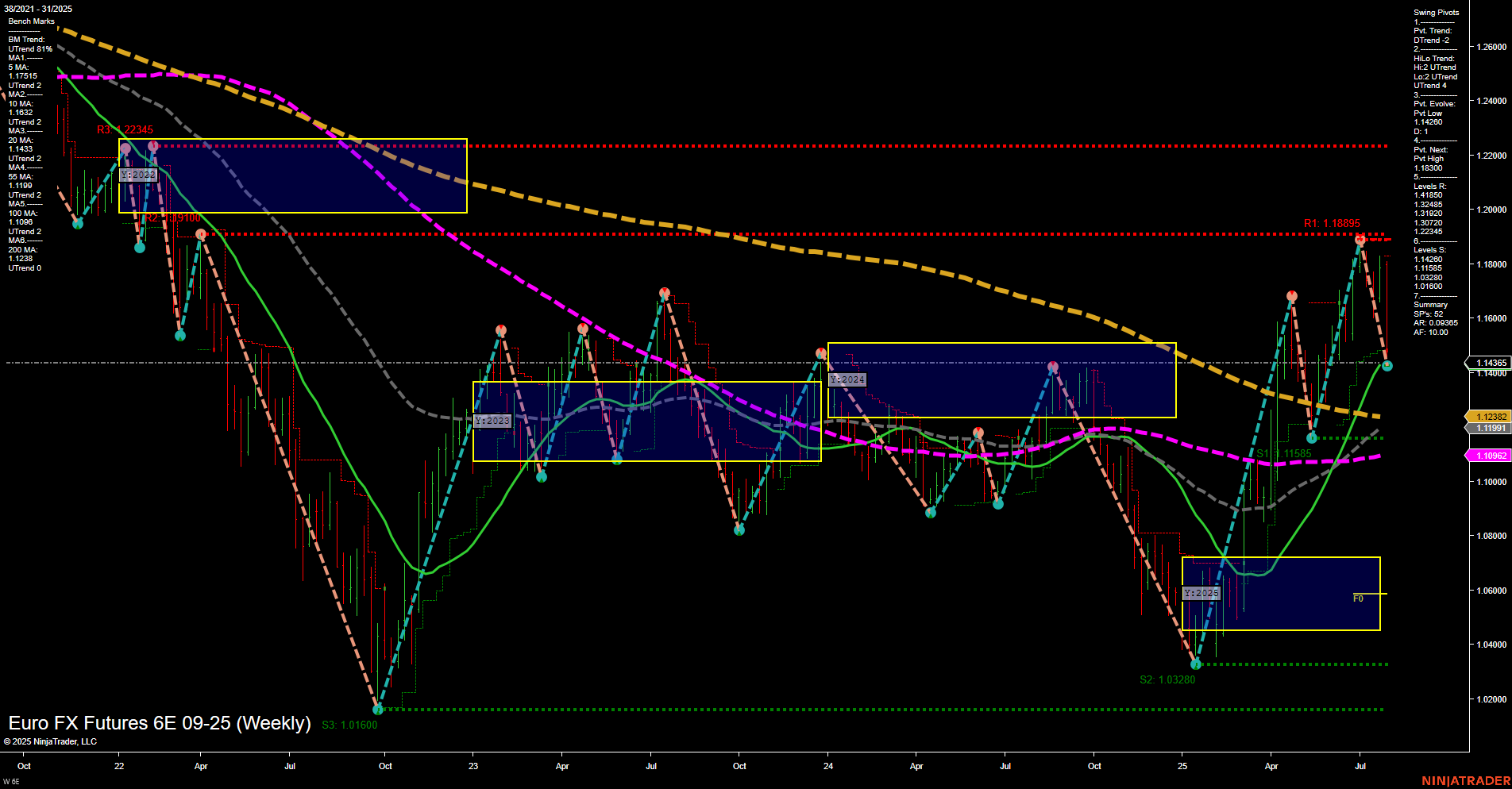

6E Euro FX Futures Weekly Chart Analysis: 2025-Aug-01 07:03 CT

Price Action

- Last: 1.14865,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: -256%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Aug

- Intermediate-Term

- MSFG Current: -3%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: 63%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 1.14200,

- 4. Pvt. Next: Pvt high 1.18895,

- 5. Levels R: 1.22345, 1.18895, 1.18300, 1.14865,

- 6. Levels S: 1.11585, 1.10600, 1.03280.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 1.17115 Down Trend,

- (Intermediate-Term) 10 Week: 1.16292 Down Trend,

- (Long-Term) 20 Week: 1.14865 Up Trend,

- (Long-Term) 55 Week: 1.11991 Up Trend,

- (Long-Term) 100 Week: 1.10962 Up Trend,

- (Long-Term) 200 Week: 1.12382 Down Trend.

Recent Trade Signals

- 29 Jul 2025: Short 6E 09-25 @ 1.162 Signals.USAR.TR720

- 28 Jul 2025: Short 6E 09-25 @ 1.17795 Signals.USAR-MSFG

- 25 Jul 2025: Short 6E 09-25 @ 1.1761 Signals.USAR.TR120

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Neutral,

- Long-Term: Bullish.

Key Insights Summary

The 6E Euro FX Futures weekly chart shows a market in transition. Short-term momentum is fast and to the downside, with large bars and price action below the weekly and monthly session fib grid neutral zones, confirming a bearish short-term environment. Recent trade signals have also been to the short side, reinforcing this view. Intermediate-term signals are mixed: while the monthly fib grid trend is down and moving averages are trending lower, the swing pivot HiLo trend remains up, suggesting some underlying support or a possible pause in the downtrend. Long-term, the yearly session fib grid trend is up, and most long-term moving averages are in uptrends, indicating that the broader bullish structure remains intact despite recent pullbacks. Key resistance levels are clustered above, with 1.18895 and 1.22345 as major upside hurdles, while support is found at 1.11585 and lower. The market appears to be in a corrective phase within a larger uptrend, with volatility and wide price swings. This environment may favor tactical swing trading, with attention to potential reversals at key support or resistance levels.

Chart Analysis ATS AI Generated: 2025-08-01 07:03 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.