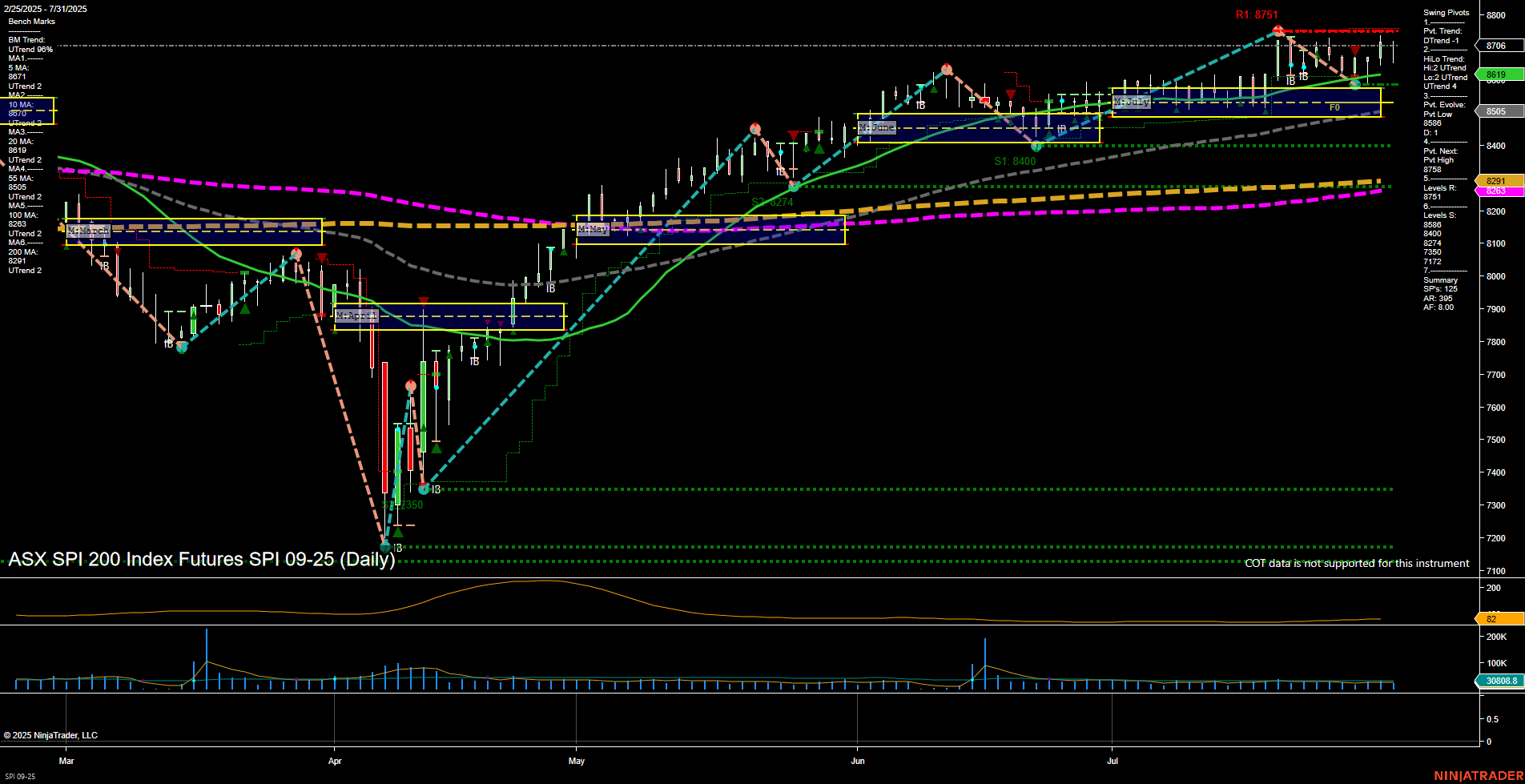

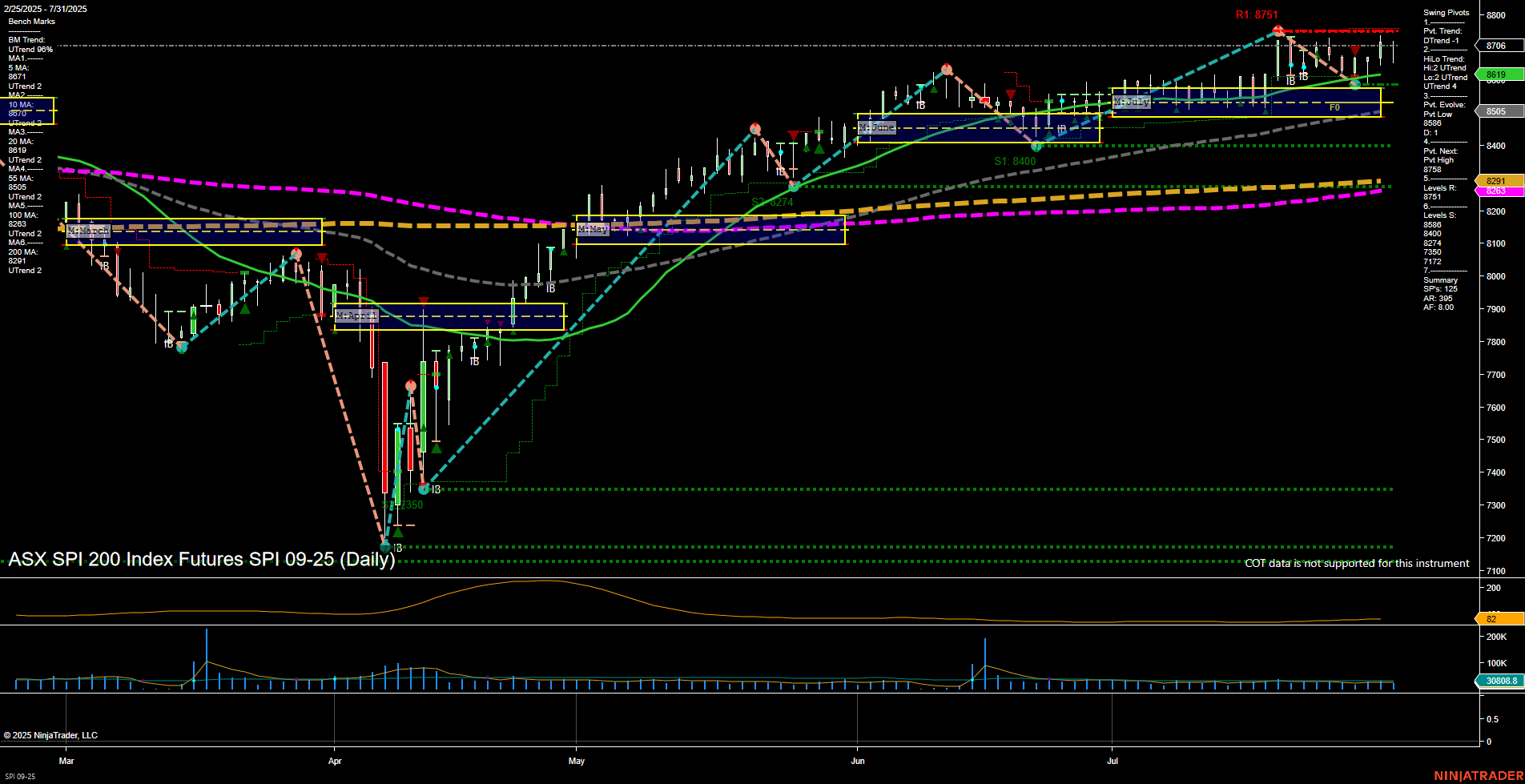

SPI ASX SPI 200 Index Futures Daily Chart Analysis: 2025-Jul-31 07:13 CT

Price Action

- Last: 8706,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Jul

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 8619,

- 4. Pvt. Next: Pvt high 8758,

- 5. Levels R: 8751, 8706,

- 6. Levels S: 8619, 8505, 8400.

Daily Benchmarks

- (Short-Term) 5 Day: 8677 Up Trend,

- (Short-Term) 10 Day: 8679 Up Trend,

- (Intermediate-Term) 20 Day: 8718 Up Trend,

- (Intermediate-Term) 55 Day: 8605 Up Trend,

- (Long-Term) 100 Day: 8291 Up Trend,

- (Long-Term) 200 Day: 8305 Up Trend.

Additional Metrics

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The SPI 200 Index Futures daily chart shows a market that has recently shifted to a short-term downtrend (DTrend) as indicated by the latest swing pivot, despite the intermediate and long-term trends remaining firmly upward. Price is consolidating near recent highs, with resistance at 8751 and support at 8619 and 8505. All benchmark moving averages are trending up, confirming underlying bullish momentum on higher timeframes. The ATR and volume metrics suggest moderate volatility and steady participation. The market appears to be in a consolidation or minor pullback phase within a broader uptrend, with no clear breakout or breakdown at this stage. This environment often precedes either a continuation of the uptrend or a deeper retracement, so swing traders will be watching for a decisive move above resistance or a breakdown below support to confirm the next directional leg.

Chart Analysis ATS AI Generated: 2025-07-31 07:14 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.