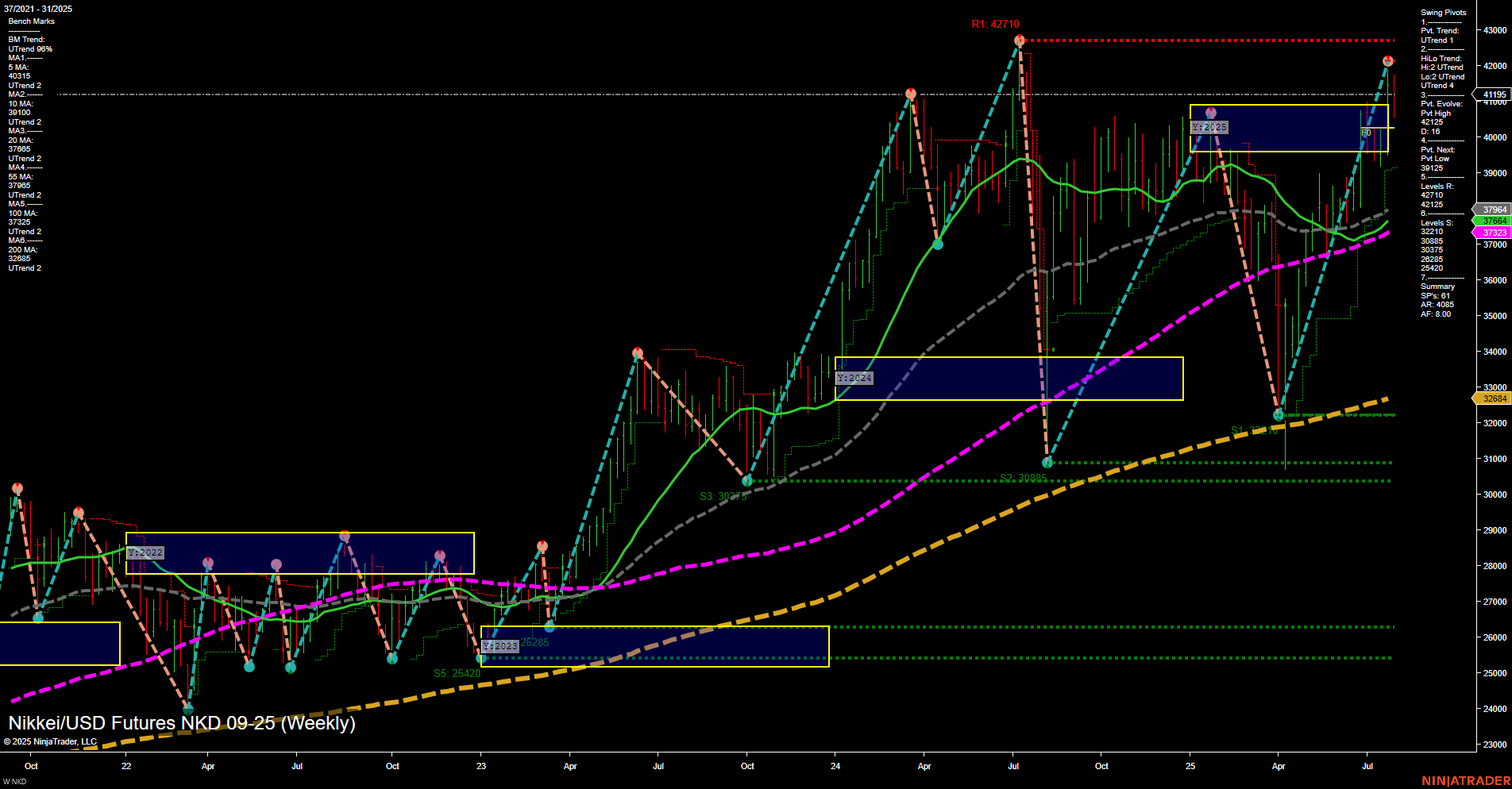

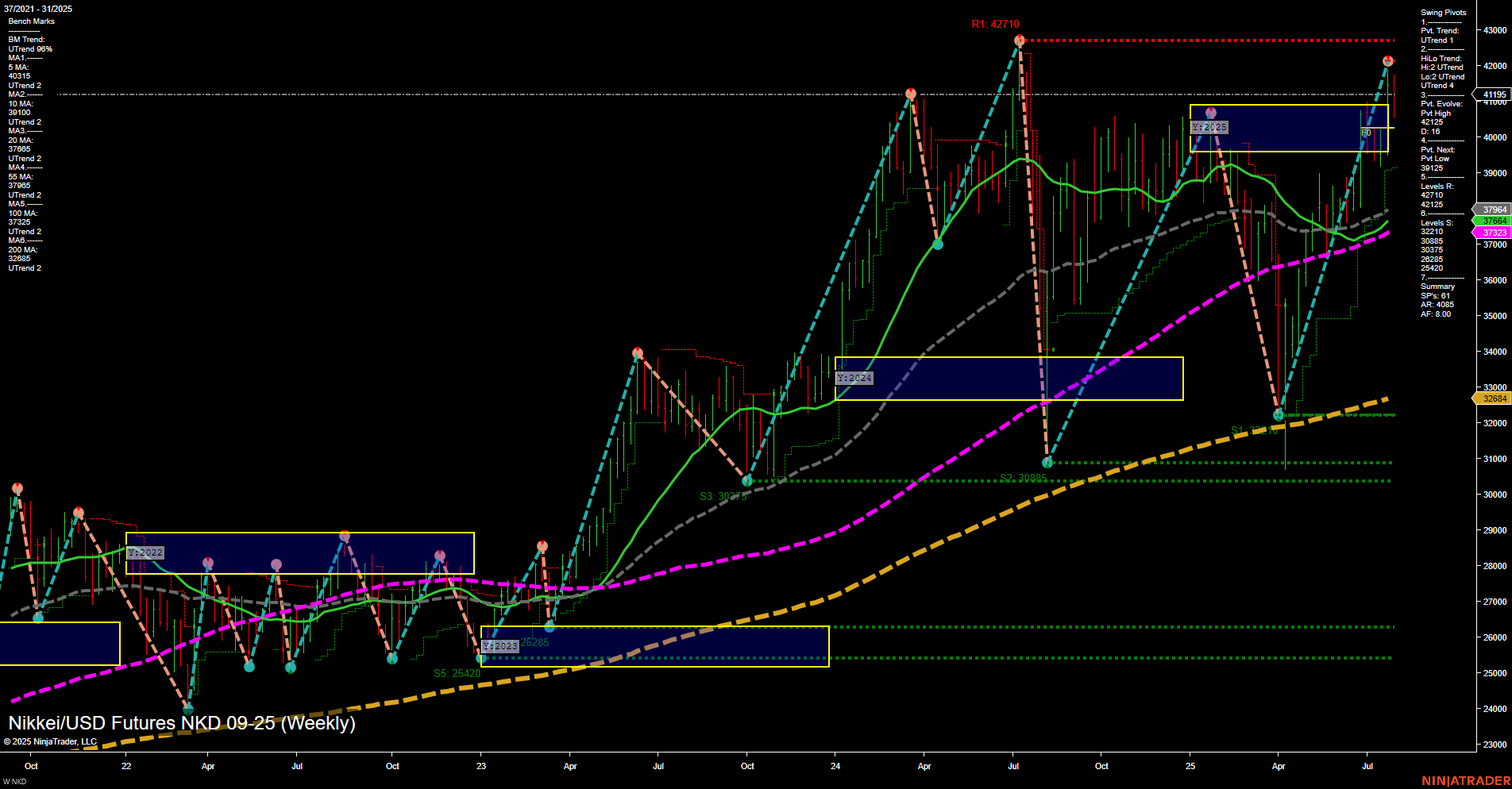

NKD Nikkei/USD Futures Weekly Chart Analysis: 2025-Jul-31 07:09 CT

Price Action

- Last: 41195,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: -28%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Jul

- Intermediate-Term

- MSFG Current: 25%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 14%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 42710,

- 4. Pvt. Next: Pvt low 39125,

- 5. Levels R: 42710, 42215,

- 6. Levels S: 37964, 37664, 37233, 37000.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 40315 Up Trend,

- (Intermediate-Term) 10 Week: 39100 Up Trend,

- (Long-Term) 20 Week: 37665 Up Trend,

- (Long-Term) 55 Week: 37305 Up Trend,

- (Long-Term) 100 Week: 37425 Up Trend,

- (Long-Term) 200 Week: 32684 Up Trend.

Recent Trade Signals

- 31 Jul 2025: Long NKD 09-25 @ 41130 Signals.USAR.TR120

- 31 Jul 2025: Long NKD 09-25 @ 41130 Signals.USAR-MSFG

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The NKD Nikkei/USD Futures are exhibiting strong upward momentum, with the most recent weekly bar being large and fast, indicating heightened volatility and strong buying interest. Despite a short-term WSFG trend that is down and price currently below the weekly NTZ center, the swing pivot structure remains in an uptrend, with the most recent pivot high at 42,710 acting as resistance. Intermediate and long-term trends are clearly bullish, supported by all major moving averages trending upward and price holding well above these benchmarks. The monthly and yearly session fib grids both show price above their respective NTZ centers, reinforcing the longer-term bullish bias. Support levels are clustered in the 37,000–38,000 range, providing a cushion for any pullbacks. Recent trade signals confirm renewed long interest at current levels. Overall, the market is in a strong uptrend on higher timeframes, with short-term consolidation or pullback risk, but the broader structure favors continuation higher unless key support levels are breached.

Chart Analysis ATS AI Generated: 2025-07-31 07:10 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.