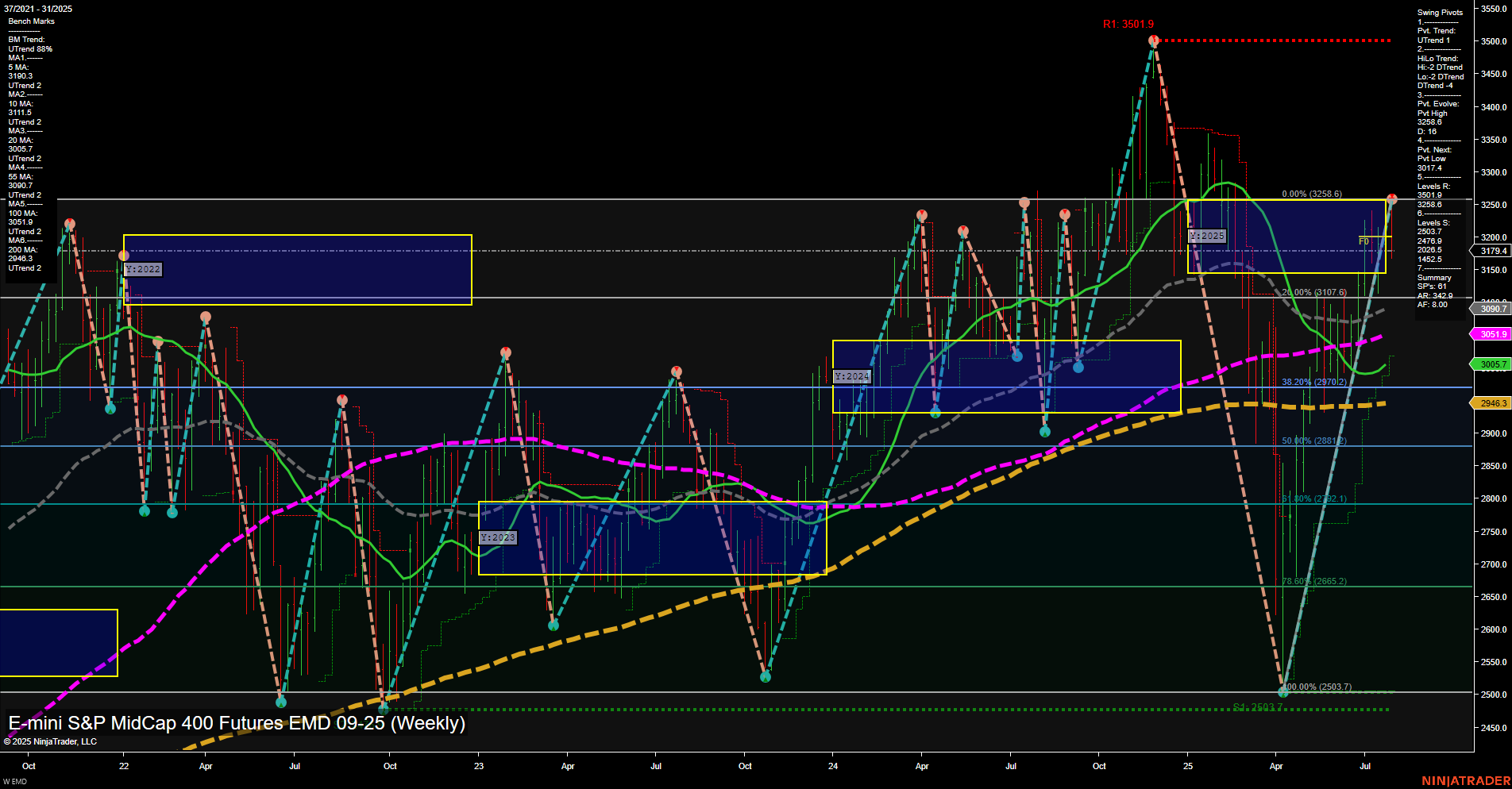

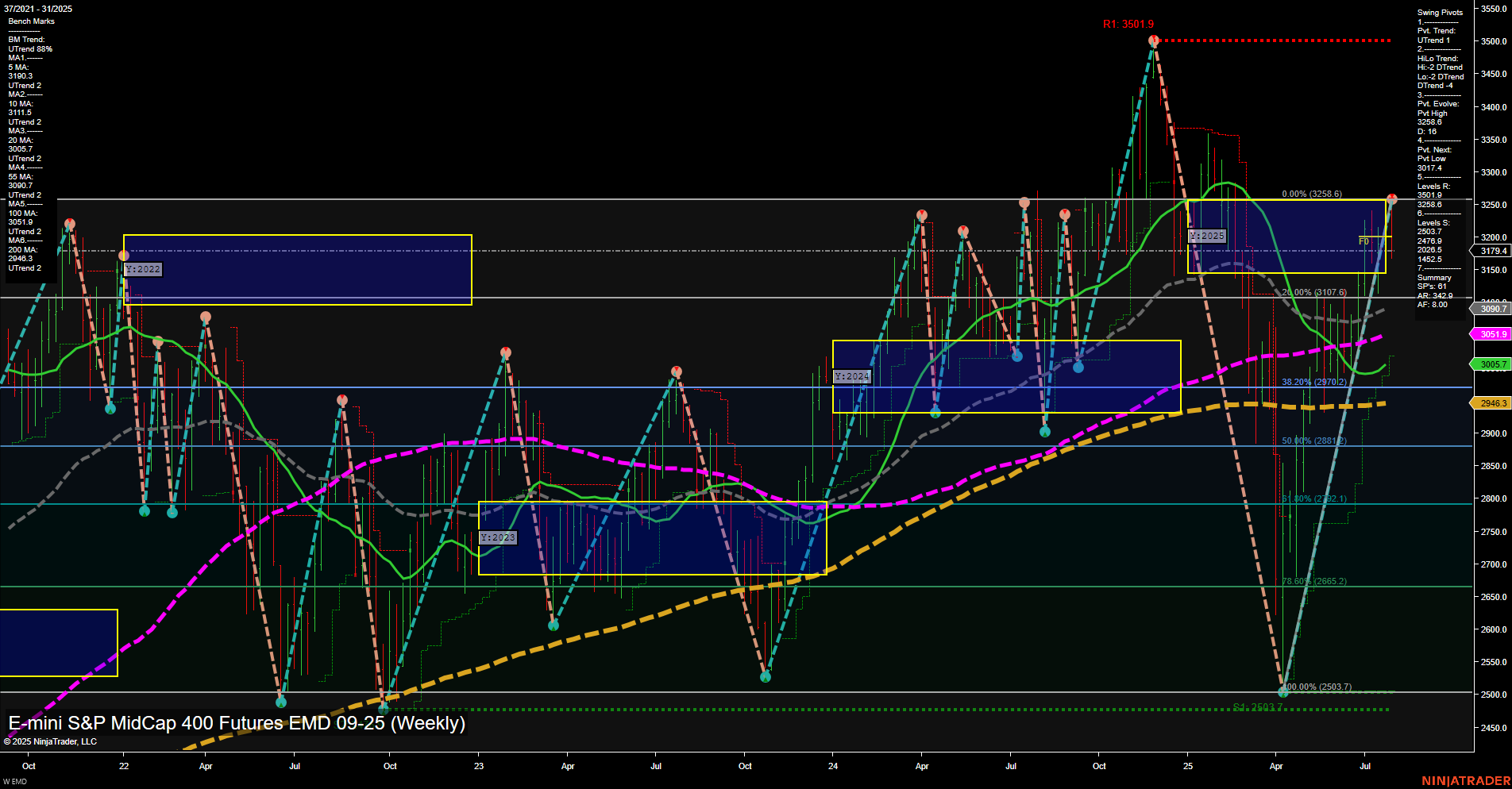

EMD E-mini S&P MidCap 400 Futures Weekly Chart Analysis: 2025-Jul-31 07:05 CT

Price Action

- Last: 3236.9,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: -78%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Jul

- Intermediate-Term

- MSFG Current: 18%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: -4%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt high 3236.9,

- 4. Pvt. Next: Pvt low 3177.9,

- 5. Levels R: 3501.9, 3236.9,

- 6. Levels S: 3177.9, 3107.6, 2970.2, 2881.7, 2665.2, 2503.7.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 3111.5 Up Trend,

- (Intermediate-Term) 10 Week: 3124.2 Up Trend,

- (Long-Term) 20 Week: 3177.9 Up Trend,

- (Long-Term) 55 Week: 3051.9 Up Trend,

- (Long-Term) 100 Week: 3005.7 Up Trend,

- (Long-Term) 200 Week: 2946.3 Up Trend.

Recent Trade Signals

- 30 Jul 2025: Short EMD 09-25 @ 3231.4 Signals.USAR-WSFG

- 25 Jul 2025: Long EMD 09-25 @ 3232.2 Signals.USAR.TR120

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bearish,

- Long-Term: Neutral.

Key Insights Summary

The EMD futures weekly chart shows a market in transition, with mixed signals across timeframes. Price action is currently at 3236.9, with medium-sized bars and average momentum, indicating neither strong buying nor selling pressure. The short-term WSFG trend is down, with price below the NTZ, but the swing pivot trend is up, suggesting a possible short-term bounce or retracement within a broader downtrend. Intermediate-term signals are conflicted: the MSFG trend is up, but the HiLo swing trend is down, and recent trade signals have flipped between long and short, reflecting choppy, indecisive price action. Long-term, the YSFG trend is down, but all major moving averages (20, 55, 100, 200 week) are in uptrends, showing underlying support and a possible base-building phase. Key resistance is at 3501.9 and 3236.9, with support levels layered below at 3177.9 and 3107.6. The market appears to be consolidating after a strong rally, with potential for further sideways movement or a test of lower support if sellers regain control. Overall, the environment is characterized by volatility and a lack of clear directional conviction, with both trend continuation and reversal scenarios possible in the coming weeks.

Chart Analysis ATS AI Generated: 2025-07-31 07:05 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.