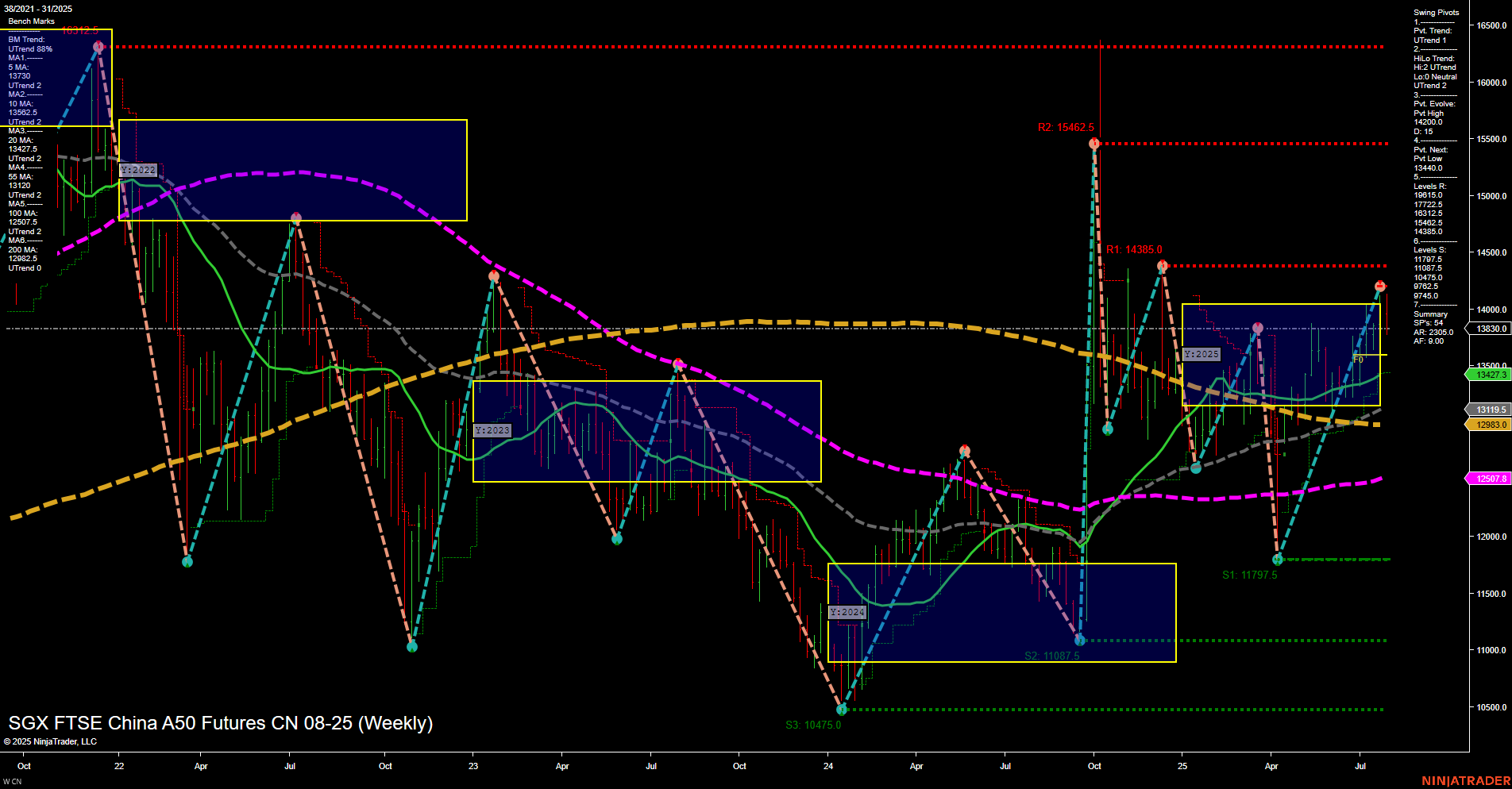

The CN SGX FTSE China A50 Futures weekly chart shows a market in transition, with recent price action characterized by medium-sized bars and average momentum, suggesting a steady but not aggressive move. The short-term swing pivot trend is up, supported by both the 5-week and 10-week moving averages trending higher, indicating bullish sentiment in the near term. Intermediate-term signals also lean bullish, with the HiLo trend shifting from neutral to up and the 20-week moving average confirming upward momentum. However, long-term benchmarks (55, 100, and 200-week MAs) remain in a downtrend, reflecting residual bearishness from previous cycles and a market still working through a broader base-building phase. Resistance levels are clustered above at 13,445.0, 13,722.5, 14,385.0, and 15,462.5, while support is well-defined below at 11,975.0, 11,087.5, and 10,475.0, suggesting a wide trading range. The price is currently testing the upper boundary of the NTZ (neutral zone), hinting at a possible breakout attempt, but the overall structure remains neutral on the yearly and monthly session fib grids, indicating the market is consolidating after a period of volatility. The chart reflects a market that has recovered from a significant low, forming higher lows and attempting to establish a new uptrend, but still faces overhead resistance and long-term skepticism. Swing traders may note the potential for continued upward swings in the short to intermediate term, but should remain aware of the broader consolidation and the need for confirmation above key resistance levels for a sustained trend shift.