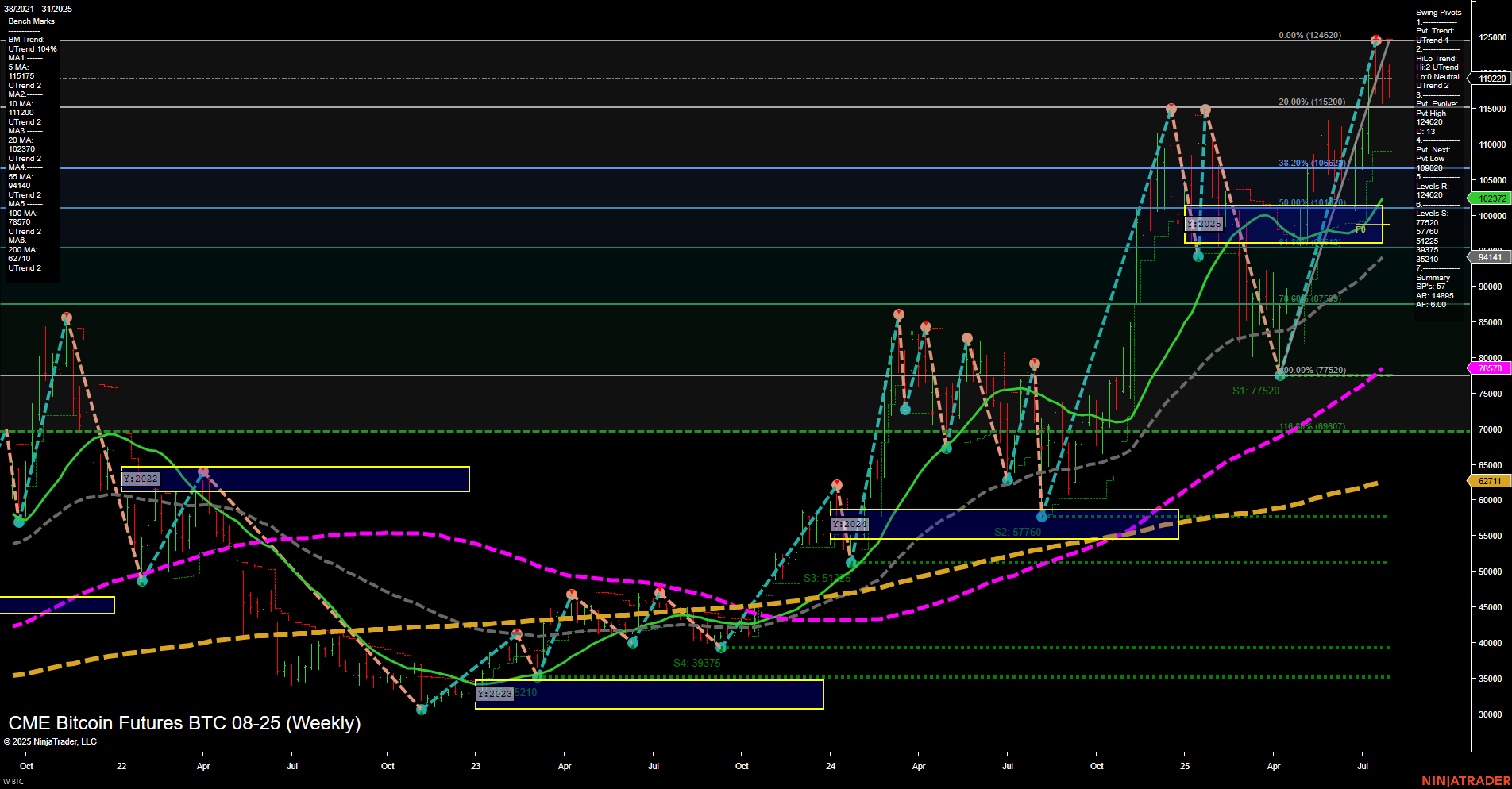

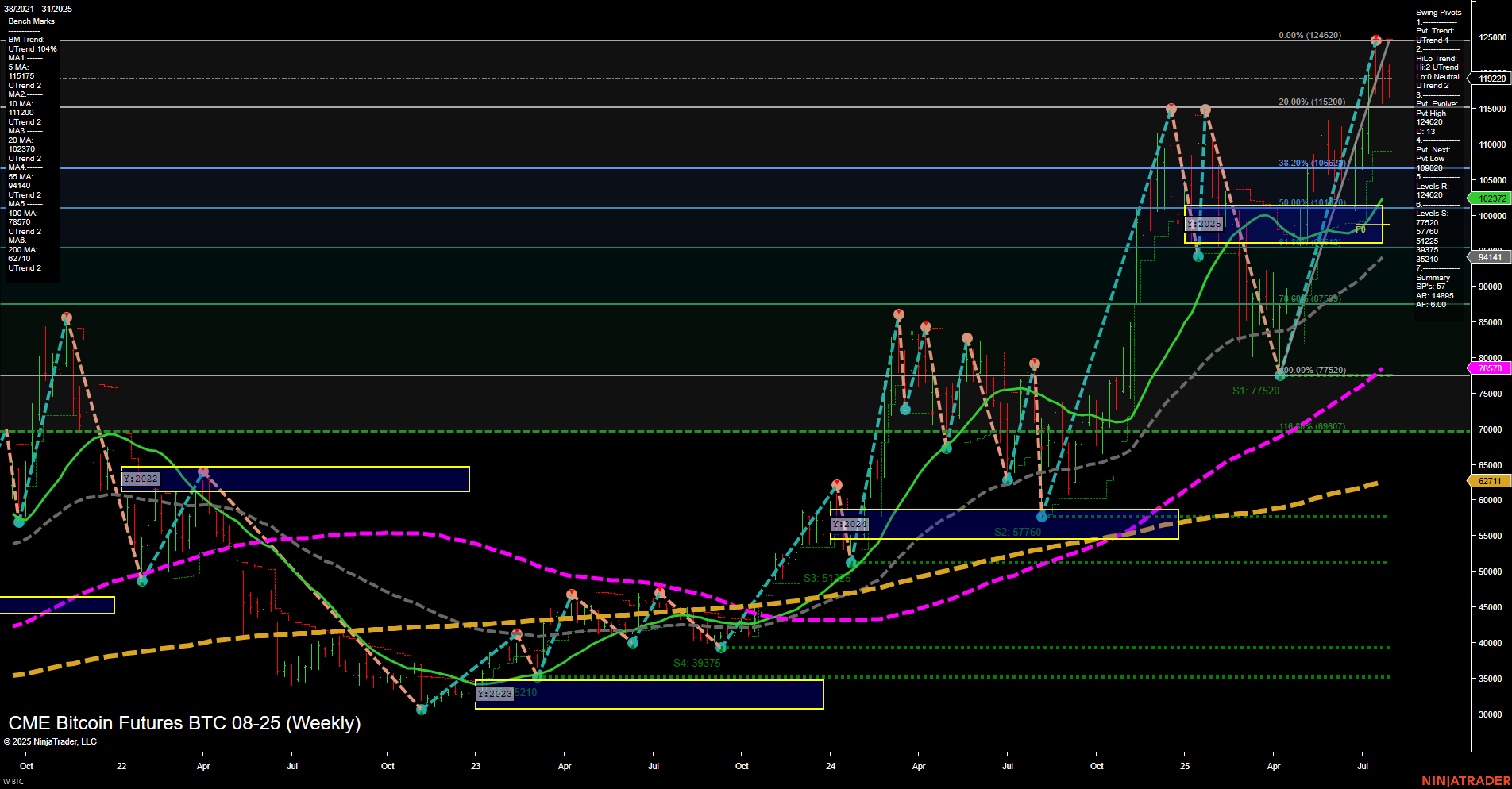

BTC CME Bitcoin Futures Weekly Chart Analysis: 2025-Jul-31 07:02 CT

Price Action

- Last: 119220,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: -11%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Jul

- Intermediate-Term

- MSFG Current: 61%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 78%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 124620,

- 4. Pvt. Next: Pvt low 109062,

- 5. Levels R: 124620, 115200, 106625,

- 6. Levels S: 100000, 87750, 77520, 57760, 5210, 39375.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 115175 Up Trend,

- (Intermediate-Term) 10 Week: 111200 Up Trend,

- (Long-Term) 20 Week: 103730 Up Trend,

- (Long-Term) 55 Week: 78570 Up Trend,

- (Long-Term) 100 Week: 62711 Up Trend,

- (Long-Term) 200 Week: 52110 Up Trend.

Recent Trade Signals

- 25 Jul 2025: Short BTC 08-25 @ 118440 Signals.USAR-WSFG

Overall Rating

- Short-Term: Neutral

- Intermediate-Term: Bullish

- Long-Term: Bullish

Key Insights Summary

BTC CME Bitcoin Futures are exhibiting strong upward momentum on the weekly chart, with large bars and fast price action. The short-term WSFG trend has turned down, with price currently below the NTZ center, suggesting a possible short-term pullback or consolidation after a strong rally. However, both the intermediate and long-term trends remain firmly bullish, as indicated by the MSFG and YSFG trends, as well as all benchmark moving averages trending upward. Swing pivots show the most recent evolution at a new high (124620), with the next key pivot low at 109062, and major resistance levels above current price. Support is layered below, with significant levels at 100000 and 87750. The recent short signal (USAR-WSFG) aligns with the short-term WSFG downtrend, but the broader context remains constructive for bulls. Overall, the market is in a strong uptrend on higher timeframes, with short-term volatility and potential for retracement or consolidation before the next directional move.

Chart Analysis ATS AI Generated: 2025-07-31 07:03 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.