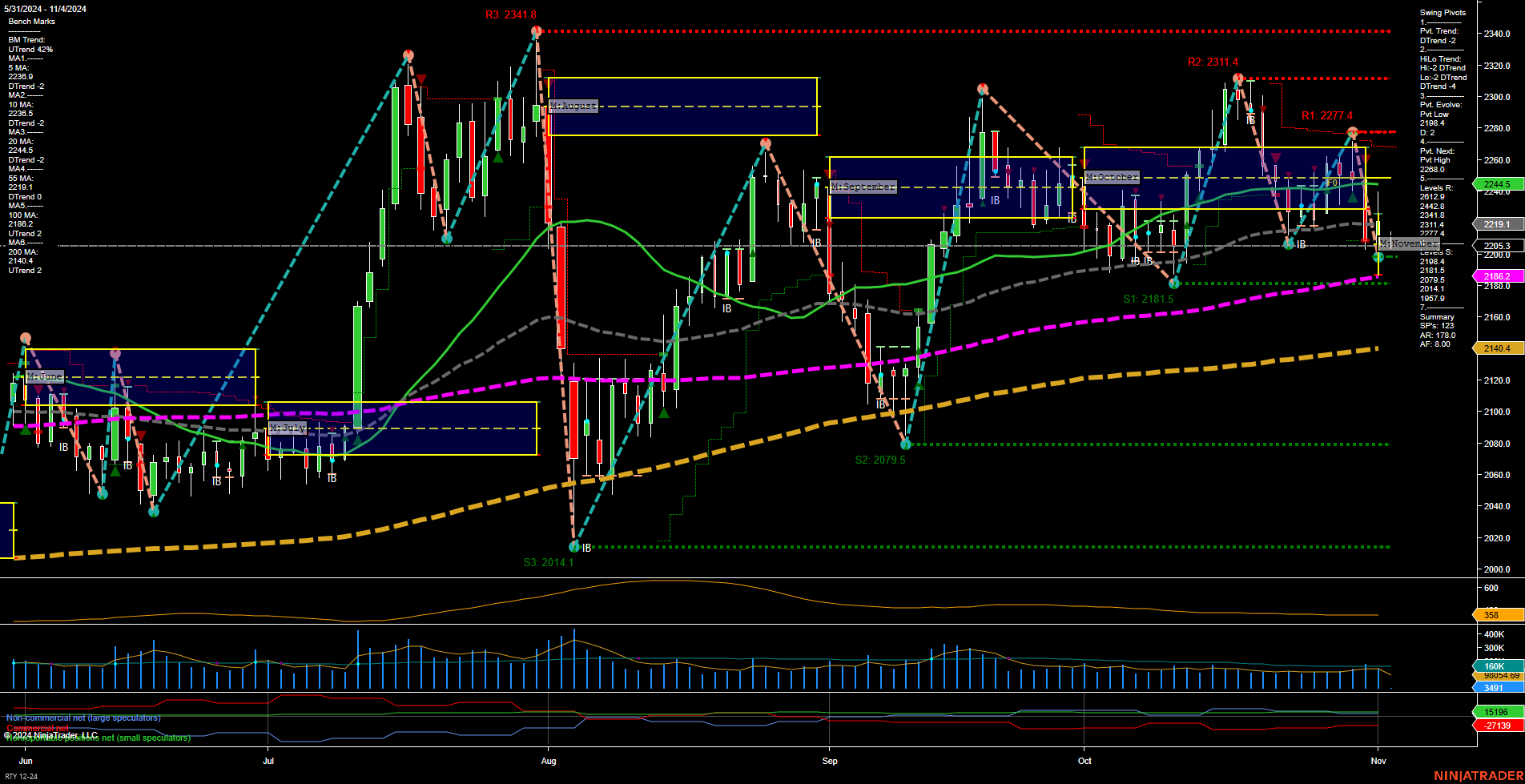

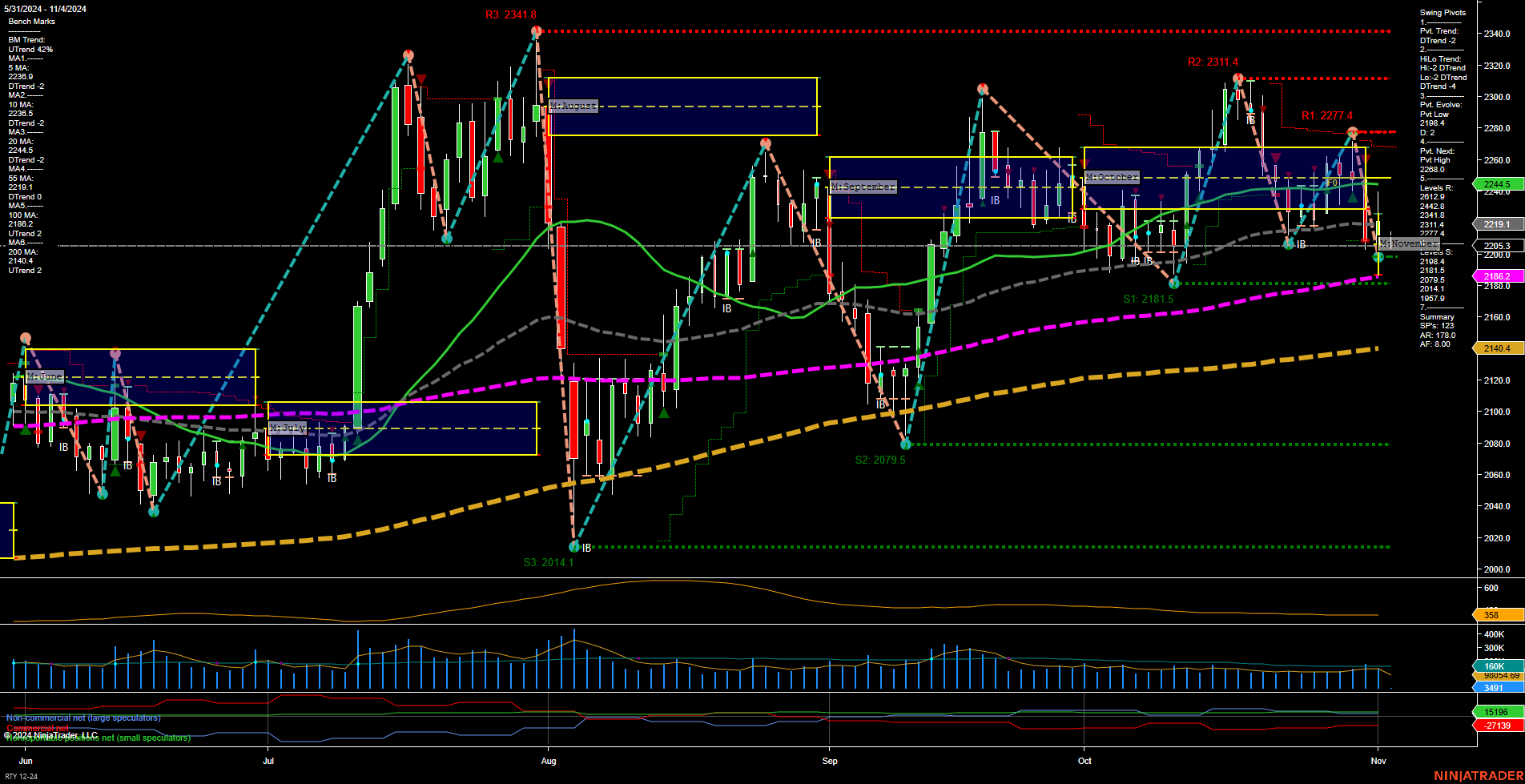

RTY E-mini Russell 2000 Index Futures Daily Chart Analysis: 2024-Nov-03 18:07 CT

Price Action

- Last: 2186.7,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: -26%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: 1%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

- MSFG vs Prior MSFG: Open higher,

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 2184.8,

- 4. Pvt. Next: Pvt high 2268.0,

- 5. Levels R: 2277.4, 2311.4,

- 6. Levels S: 2181.5, 2079.5.

Daily Benchmarks

- (Short-Term) 5 Day: 2205.3 Down Trend,

- (Short-Term) 10 Day: 2219.1 Down Trend,

- (Intermediate-Term) 20 Day: 2244.5 Down Trend,

- (Intermediate-Term) 55 Day: 2268.8 Down Trend,

- (Long-Term) 100 Day: 2186.0 Up Trend,

- (Long-Term) 200 Day: 2140.0 Up Trend.

Additional Metrics

Recent Trade Signals

- 01 Nov 2024: Long RTY 12-24 @ 2234.2 Signals.USAR-WSFG

- 31 Oct 2024: Short RTY 12-24 @ 2225.3 Signals.USAR.TR120

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Neutral.

Key Insights Summary

The RTY E-mini Russell 2000 Index Futures are currently experiencing a bearish short-term and intermediate-term trend, as indicated by the downward movement in both the Weekly and Monthly Session Fib Grids. The recent price action shows medium-sized bars with average momentum, suggesting a potential continuation of the current trend. The swing pivots highlight resistance levels at 2277.4 and 2311.4, with support at 2181.5 and 2079.5. The daily benchmarks indicate a downtrend in the short and intermediate terms, while the long-term trend remains neutral. Recent trade signals reflect mixed strategies, with a short position followed by a long position, indicating potential volatility and market indecision.

Chart Analysis ATS AI Generated: 2024-11-03 18:07 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2024. Algo Trading Systems LLC.