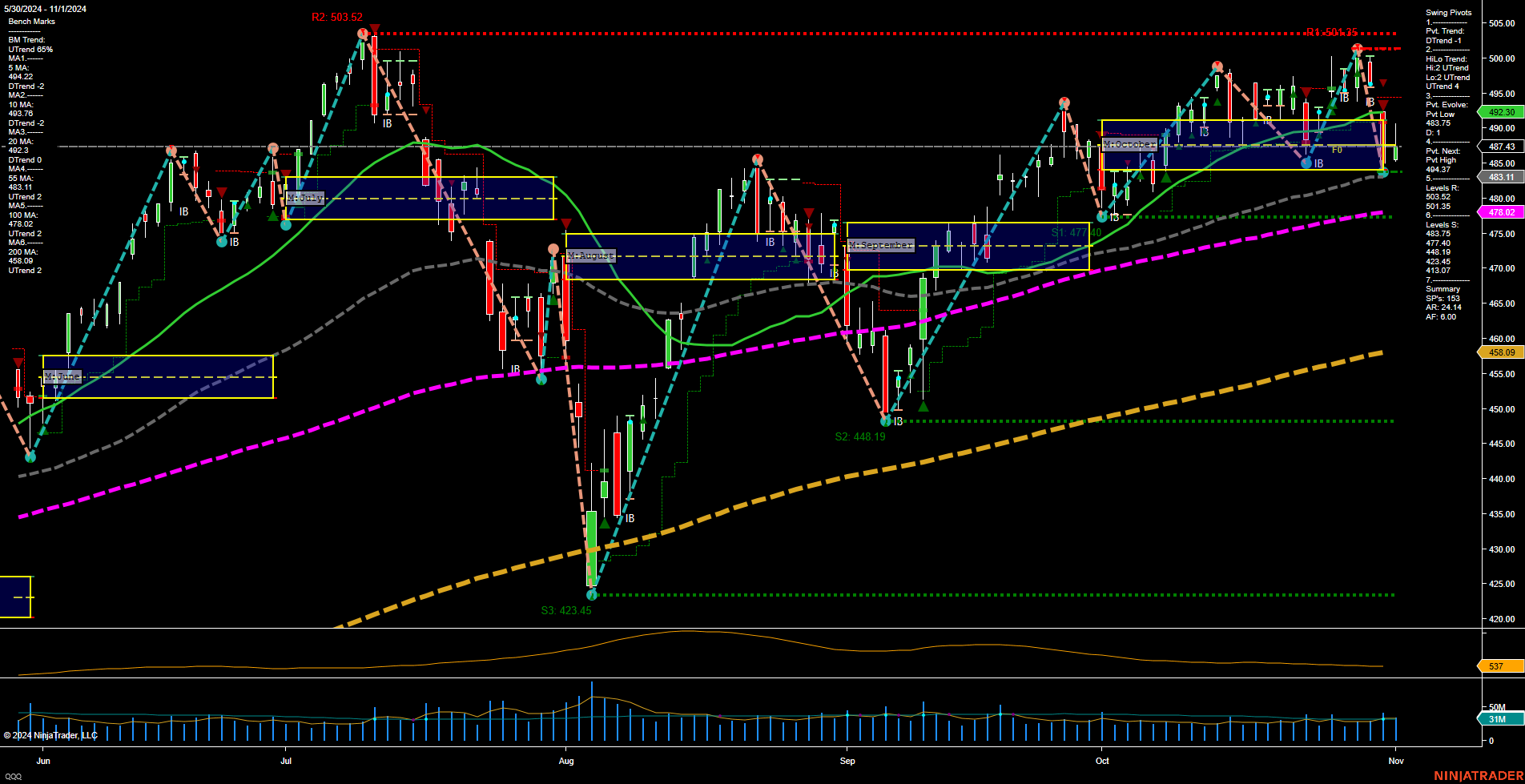

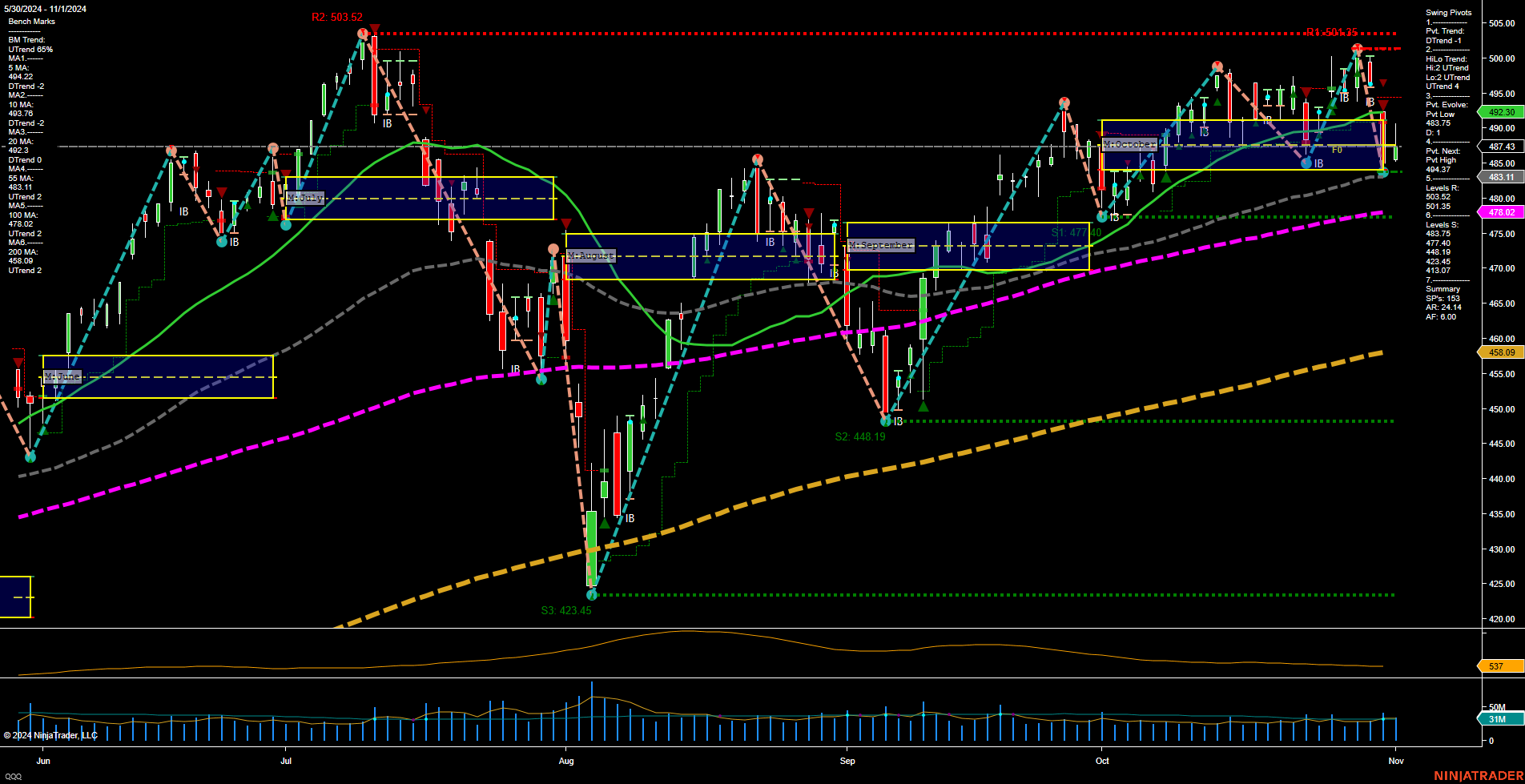

QQQ PowerShares QQQ Daily Chart Analysis: 2024-Nov-03 18:06 CT

Price Action

- Last: 492.30,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

- MSFG vs Prior MSFG: Open higher,

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 483.75,

- 4. Pvt. Next: Pvt high 490.00,

- 5. Levels R: 503.52, 501.35, 490.00,

- 6. Levels S: 483.11, 464.37, 448.19.

Daily Benchmarks

- (Short-Term) 5 Day: 495.00 Up Trend,

- (Short-Term) 10 Day: 490.00 Up Trend,

- (Intermediate-Term) 20 Day: 483.11 Up Trend,

- (Intermediate-Term) 55 Day: 478.02 Up Trend,

- (Long-Term) 100 Day: 458.09 Up Trend,

- (Long-Term) 200 Day: 437.43 Up Trend.

Additional Metrics

- ATR: 537,

- VOLMA: 30151554.

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The QQQ chart shows a medium bar size with average momentum, indicating a stable price movement. The short-term trend is neutral, with a slight downward pivot trend, while the intermediate and long-term trends remain bullish. The price has opened higher compared to the previous MSFG, suggesting potential upward movement. Resistance levels are set at 503.52, 501.35, and 490.00, with support at 483.11, 464.37, and 448.19. The moving averages across all terms are trending upwards, reinforcing the bullish outlook. The ATR indicates moderate volatility, and the volume moving average suggests consistent trading activity. Overall, the market appears to be in a consolidation phase with potential for upward continuation.

Chart Analysis ATS AI Generated: 2024-11-03 18:06 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2024. Algo Trading Systems LLC.