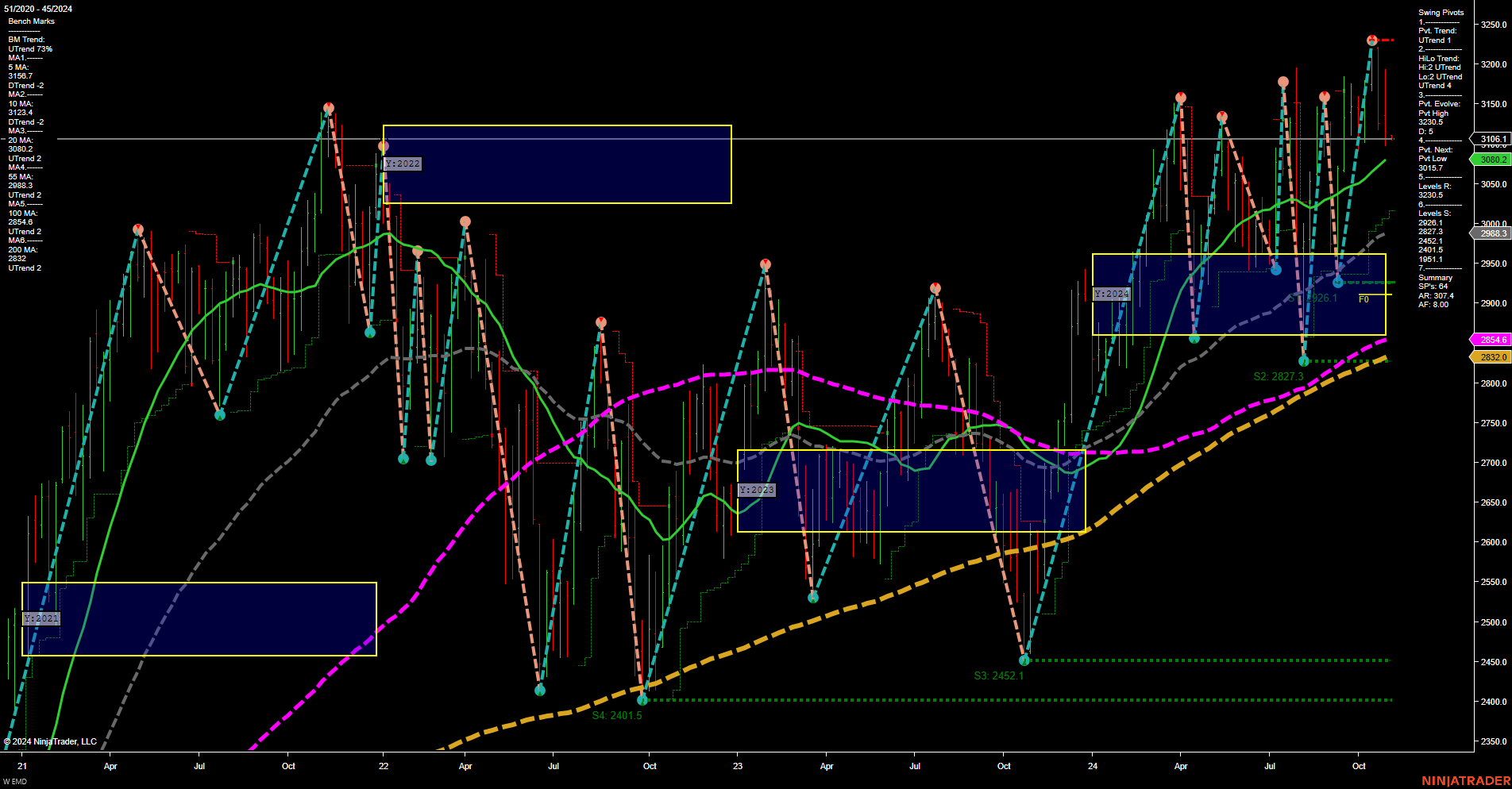

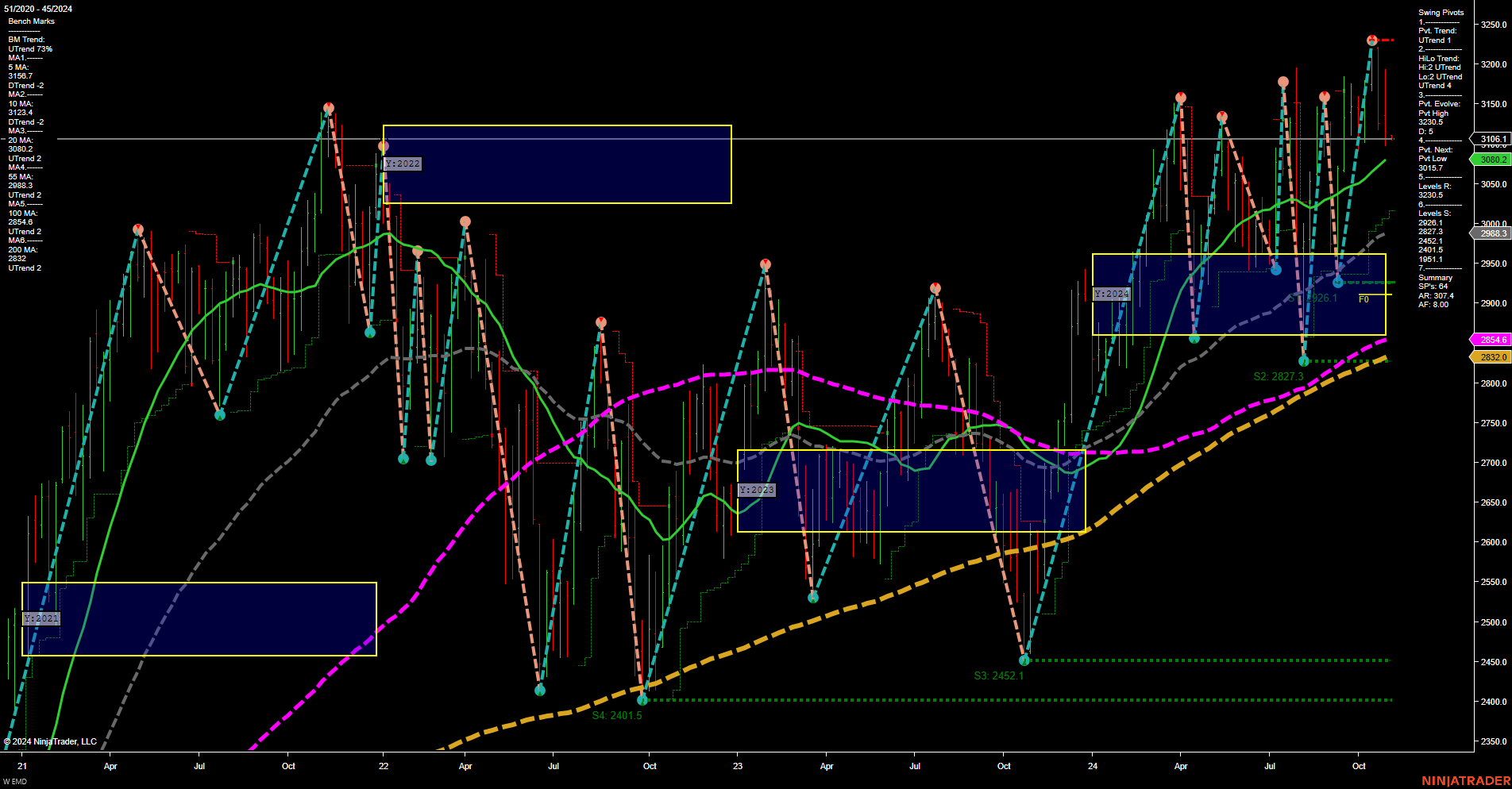

EMD E-mini S&P MidCap 400 Futures Weekly Chart Analysis: 2024-Nov-03 18:02 CT

Price Action

- Last: 3106.1,

- Bars: Medium,

- Mom: Average.

WSFG Weekly

- Short-Term

- WSFG Current: -39%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: 0%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2024

- Long-Term

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: UTrend,

- YSFG vs Prior YSFG: Open higher.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 3106.1,

- 4. Pvt. Next: Pvt low 2827.3,

- 5. Levels R: 3200.0, 3100.0,

- 6. Levels S: 2827.3, 2401.5.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 3124.4 Down Trend,

- (Intermediate-Term) 10 Week: 3112.4 Down Trend,

- (Long-Term) 20 Week: 3054.7 Up Trend,

- (Long-Term) 55 Week: 2855.4 Up Trend,

- (Long-Term) 100 Week: 2654.6 Up Trend,

- (Long-Term) 200 Week: 2382.0 Up Trend.

Recent Trade Signals

- 01 Nov 2024: Long EMD 12-24 @ 3136.4 Signals.USAR-MSFG

- 31 Oct 2024: Short EMD 12-24 @ 3121.1 Signals.USAR-WSFG

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Neutral,

- Long-Term: Bullish.

Key Insights Summary

The EMD futures are currently experiencing a mixed environment. Short-term indicators show a downtrend with price action below the WSFG, suggesting potential weakness. However, the intermediate-term remains neutral, indicating a lack of clear direction. Long-term trends are bullish, supported by the upward trajectory of the yearly session fib grid and moving averages. Recent trade signals reflect this mixed sentiment, with both long and short positions being triggered. The market may be in a consolidation phase, with potential for volatility as it tests key resistance and support levels.

Chart Analysis ATS AI Generated: 2024-11-03 18:03 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2024. Algo Trading Systems LLC.